Merger and Acquisition

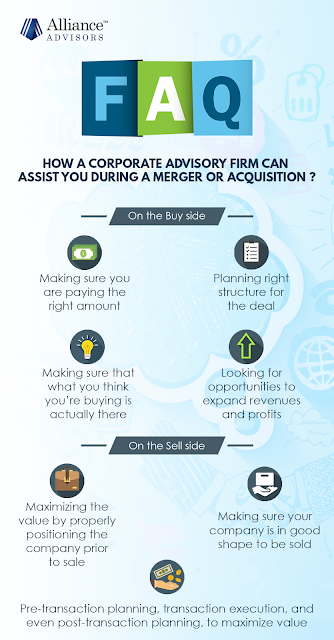

What is 'Mergers and Acquisitions - M&A' Mergers and acquisitions (M&A) is a general term that refers to the consolidation of companies or assets through various types of financial transactions. M&A can include a number of different transactions, such as mergers, acquisitions, consolidations, tender offers, purchase of assets and management acquisitions. In all cases, two companies are involved. The term M&A also refers to the department at financial institutions that deals with mergers and acquisitions Mergers and acquisitions (M&A) can include a number of different transactions and types. The following will review some of the different kinds of financial transactions that occur when companies engage in mergers and acquisitions activity. Merger and Acquisitions O verview Merger: In a merger, the boards of directors for two companies approve the combination and seek shareholders' approva...